Dry Mix Mortar Market-Growth, Trends, and Forecast (2019–2024)

The global dry mix mortar market is segmented by application (gypsum, rendering, tile adhesive, grout, waterproof mortar, concrete protection and renovation, insulation and finishing systems, and other applications), end-user industry (residential and non-residential), and geography (Asia-Pacific, North America, Europe, South America, Middle East & Africa).

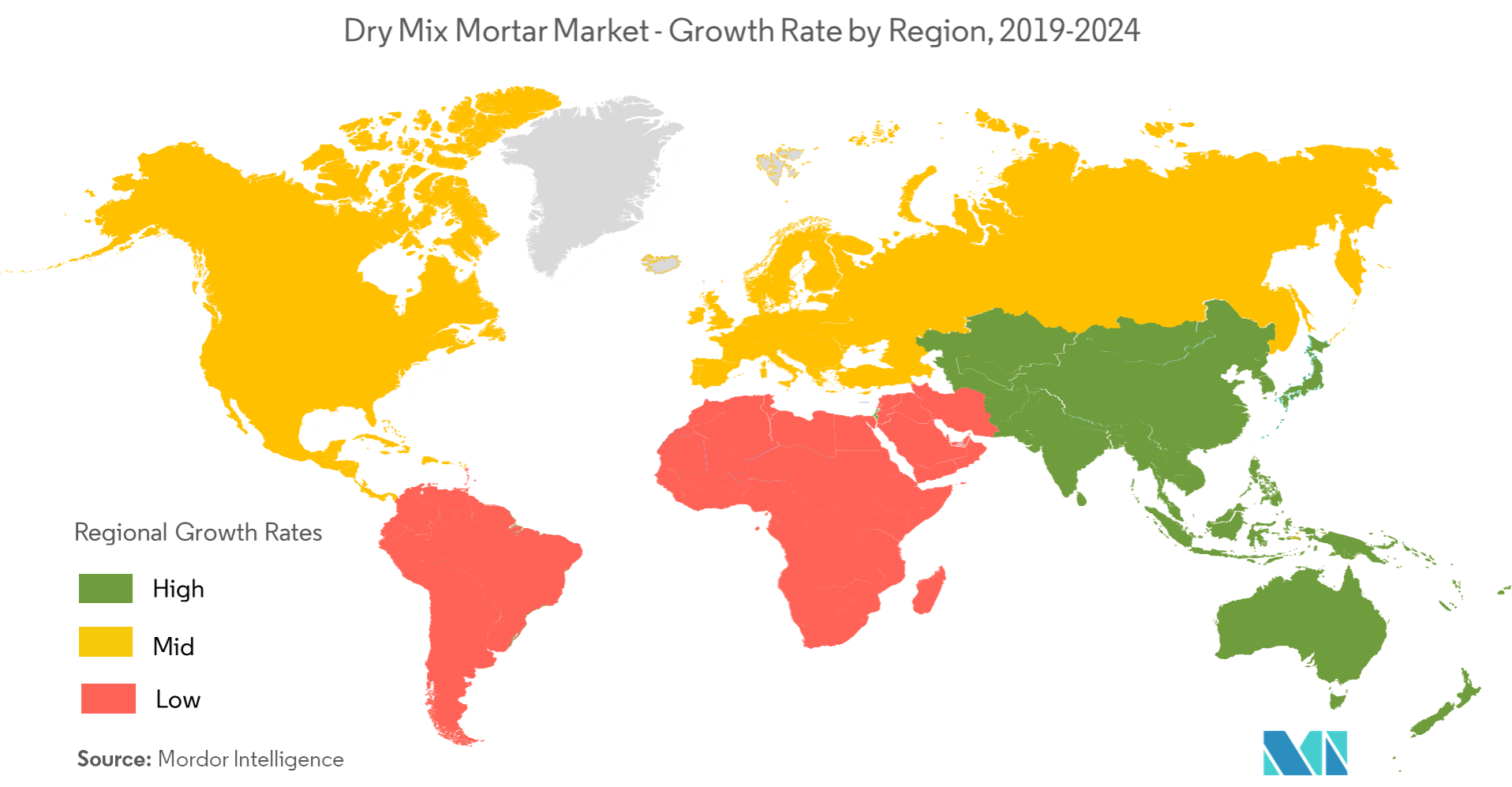

The dry mix mortar market (hereafter referred to as the market under study) is projected to register a compound annual growth rate (CAGR) of approximately 6.73% over the forecast period. Key drivers fueling the market include surging construction activities in the United States and the Asia-Pacific region. However, its higher cost compared to traditional mortar, coupled with low awareness in emerging economies, is likely to hamper market growth.

In 2018, driven by robust global construction momentum, the non-residential sector dominated the dry mix mortar market and is expected to maintain its growth trajectory through the forecast period. The emerging trend of green building certifications is poised to create significant growth opportunities ahead. The Asia-Pacific region leads the market under study, with China, India, and Japan being the top-consuming nations.

Key Market Trends

Strong demand for tile adhesive is anticipated to drive the segment to a leading CAGR of 7.25% during the forecast period.

Bonding performance is a critical customer requirement for cement-based tile adhesives, as it dictates the overall system durability. Additives incorporated into tile adhesive formulations are essential to achieving higher bond strength and thus extended service life.

Core performance requirements for tile adhesives include open time, workability, slip resistance, and adhesion under diverse conditions. Dry mix mortar is therefore integrated into tile adhesive mixes to enhance these properties. Additionally, government regulations across many regions mandate specific performance thresholds for tile adhesives, which must be strictly complied with—further boosting the adoption of dry mix mortar technology in tile adhesive applications.

Expanding construction sectors, along with rising disposable incomes in both developed and developing economies, are set to propel market growth over the forecast period.

China to Dominate the Asia-Pacific Market

China stands as a major global driver of dry mix product consumption, supported by massive ongoing infrastructure development and residential construction booms. Despite efforts to rebalance its economy toward a more service-oriented model, the Chinese government has launched large-scale construction initiatives—including funding for 250 million people to relocate to new megacities over the next decade.

With the construction sector dominated by state-owned and private enterprises, increased public and private investment in this field has pushed China's construction industry to global prominence. China constructs more high bridges than all other countries combined: on average, it builds 50 high bridges annually, compared to roughly 10 built worldwide each year by other nations.

Driven by expanding infrastructure projects and rising domestic dry mix mortar production, demand for dry mix mortar in China is expected to witness substantial growth over the forecast period.